Overview

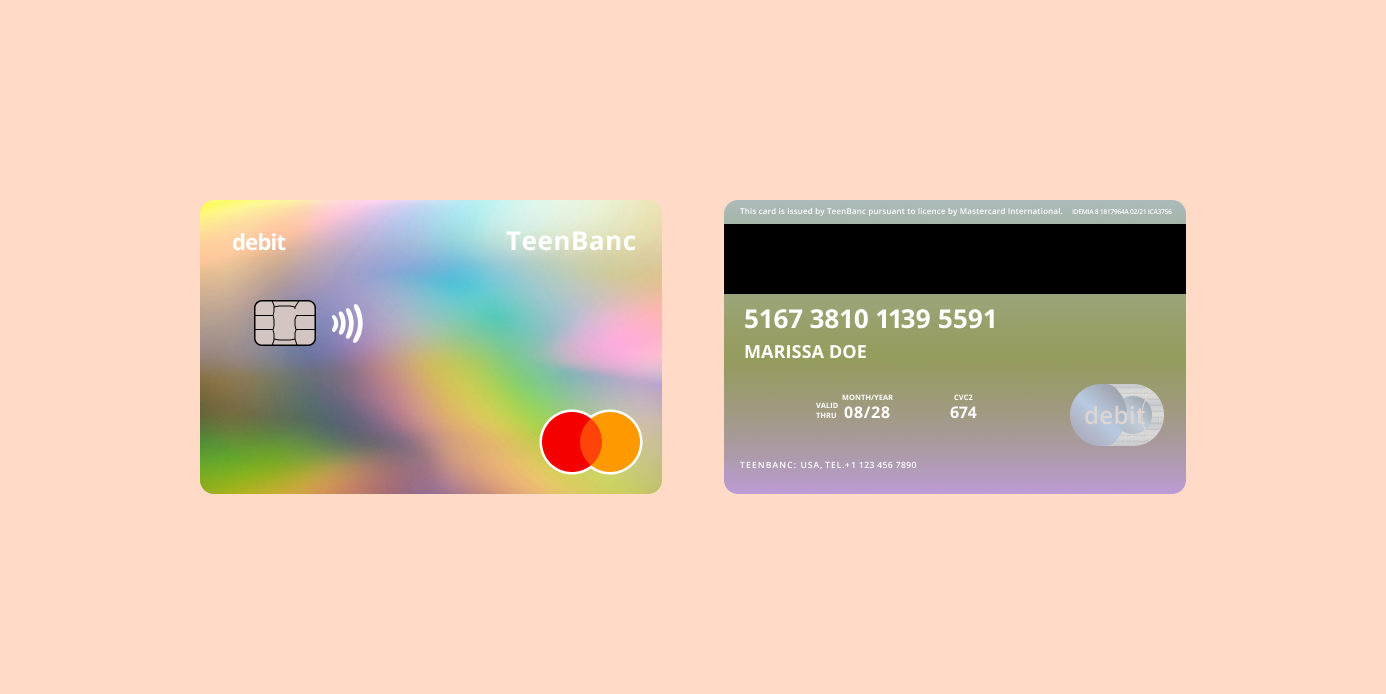

TeenBanc is a US-based fintech company with a goal to empower teens aged 13-17 to take charge of their financial futures. With a custodial bank account and a debit card, we aim to instill financial literacy through fun money lessons and secure account protection.

Deliverables

Experience Design

Interface Design

User Research

Tools

Figma

Notion

Miro

Timeline

4 Weeks

Problem & hypothesis

Lack of financial literacy is a widespread issue, with many teens entering adulthood unprepared to manage their finances. Only 17 states require high school students to take a personal finance course. Providing a real-world banking experience tailored to teens can increase financial literacy and prepare students for responsible money management as adults.

Constraints

- Strong security protections for underage users.

- Compliance with COPPA and financial regulations.

- Limited budgets of target users.

Success metrics

- Number of active teen users.

- Percentage of users who complete in-app financial literacy modules.

- User feedback on preparedness for financial independence.

Summary

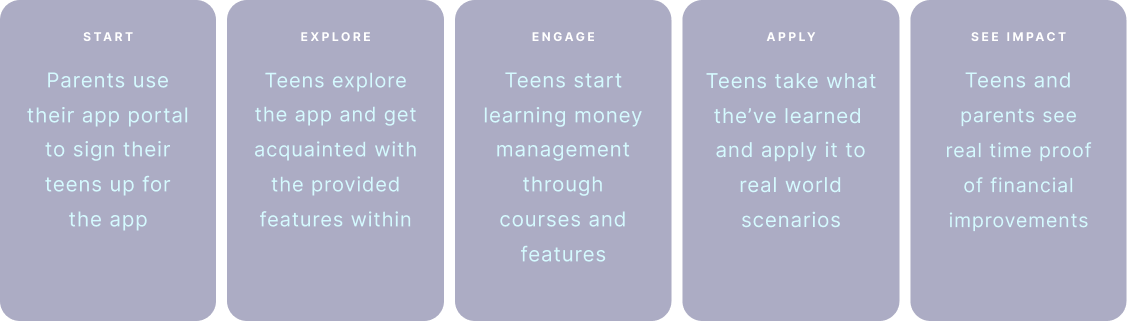

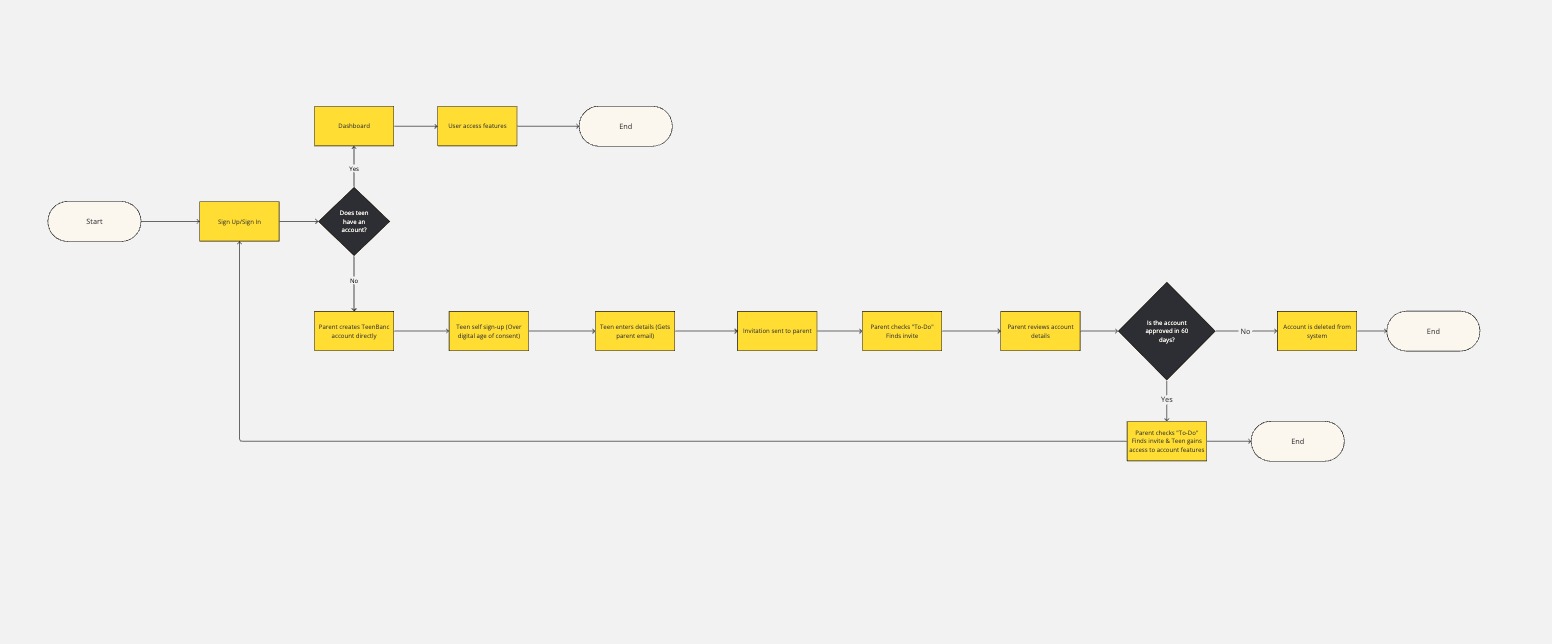

What you see above are a list of constraints and metrics to address before building the app. My goal is to create an engaging and educational experience while abiding by financial regulations. Below, you see a streamlined roadmap to be used as a north star for the user.

The user journey

“How might we make learning about personal finance engaging and simple for teenagers, while providing parents with oversight tools to ensure teens make smart money decisions?”

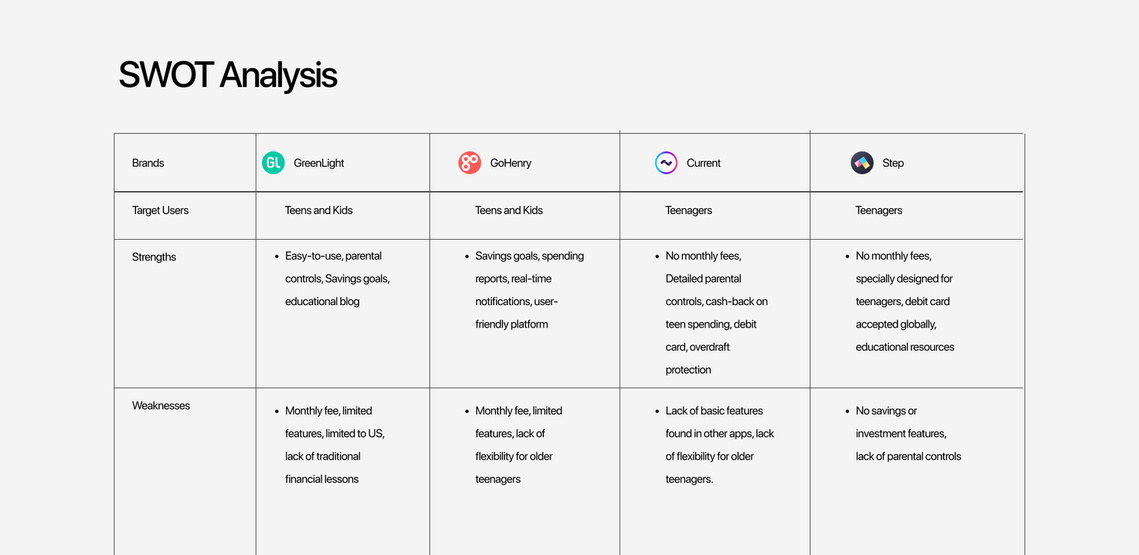

Research (Understanding our audience)

While doing market and competitor analysis, I realized that many teen banking apps focus on two areas: Starting teens early on a path to basic finance knowledge and utilization of said knowledge. Therefore, TeenBanc needed to offer expertise, guidance, and support to every user by streamlining the education process and providing clarity at every step of the journey. Providing security, support, and peace-of-mind for growing teenagers, was more important than ever.

I also conducted a user study with 10 participants aged 13-17 with a goal of uncovering preexisting financial knowledge, skills, and anxieties in participants.

A few insights gathered were:

- Teens become more tech-savvy with each generation that passes, using tools like Apple Pay and Cash App. Before age 13, 80% had already had a cell phone for 2+ years, with 90% not downloading a finance-related app until their first job (around 15.)

- Teens had little to no financial stress, with parents covering most or all of their expenses through direct payments or allowances.

- While tech has advanced, cash is used among 100% of participants.

- 70% of teens stated that doing chores and getting good grades taught them the value of earning money. Saving up allowance money to buy desirable items also taught them basic savings skills. However, more advanced concepts like investing were unfamiliar to most teens.

My goal was clear, create an app that encourages proactive learning behavior in teens.

Mapping money management

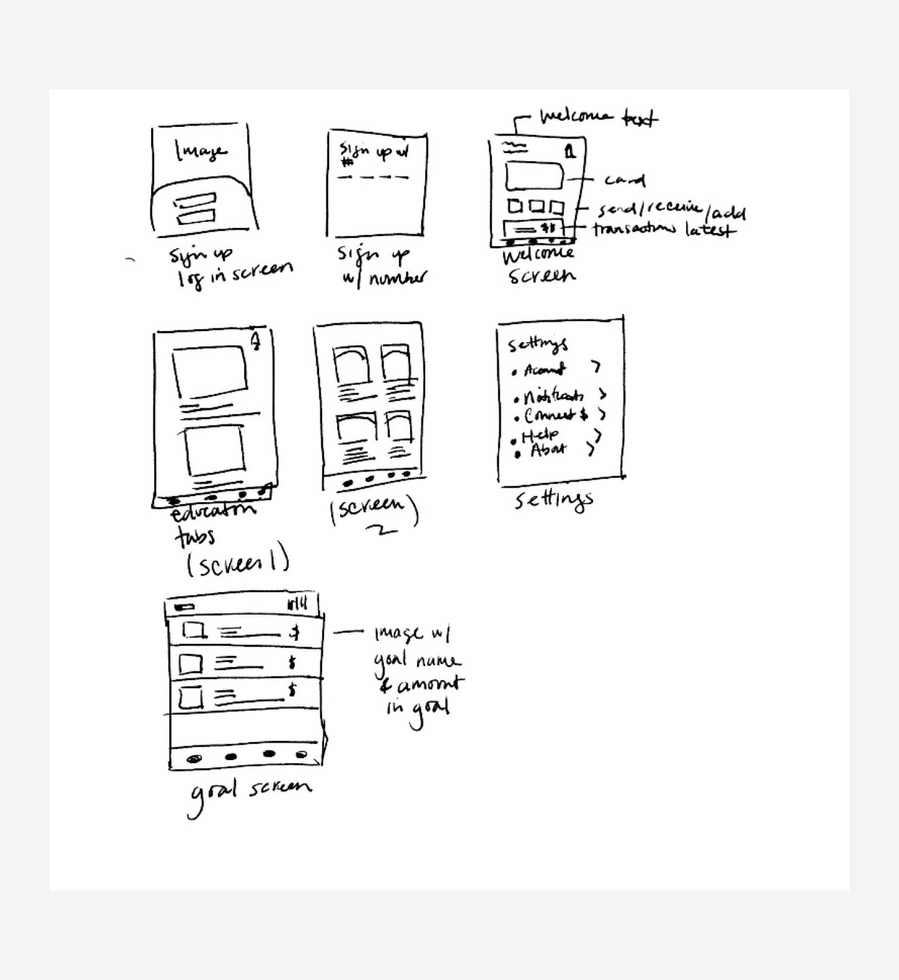

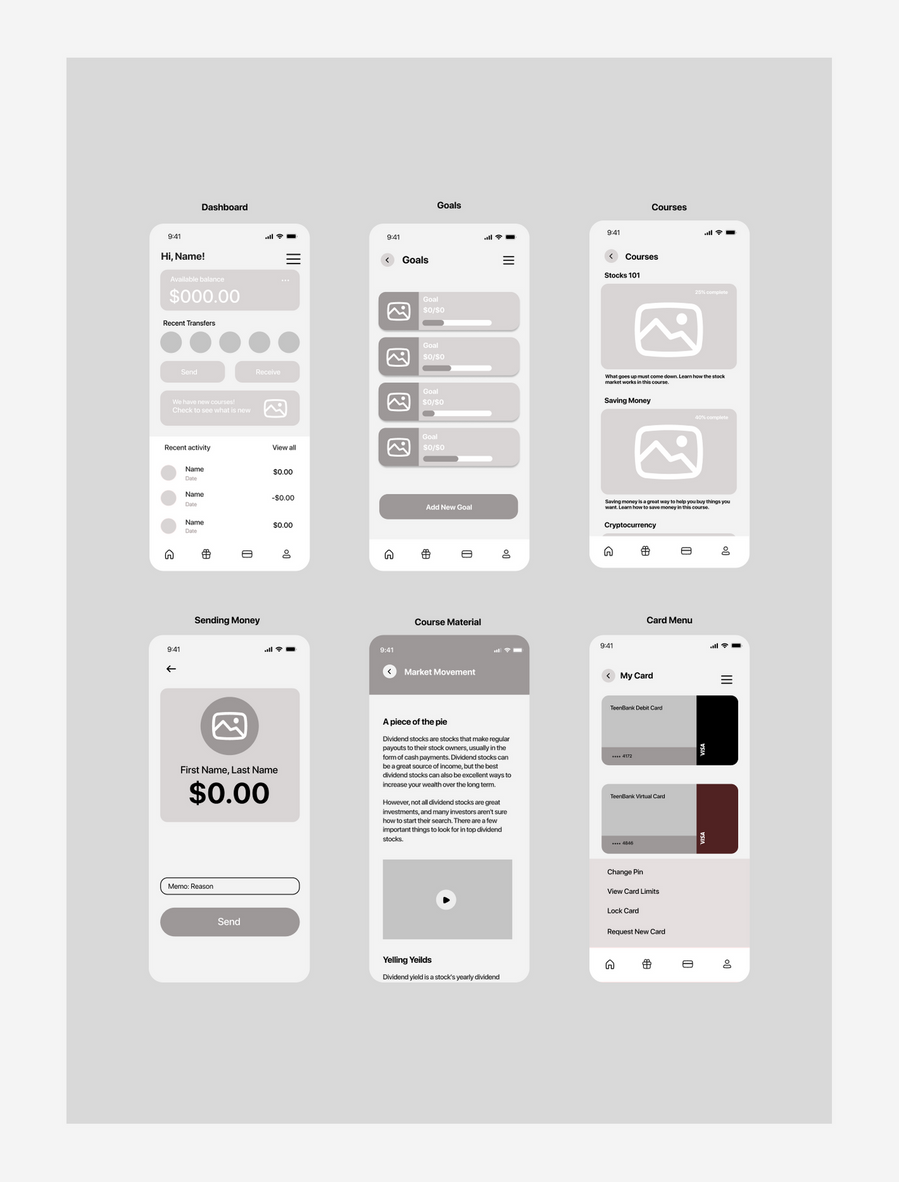

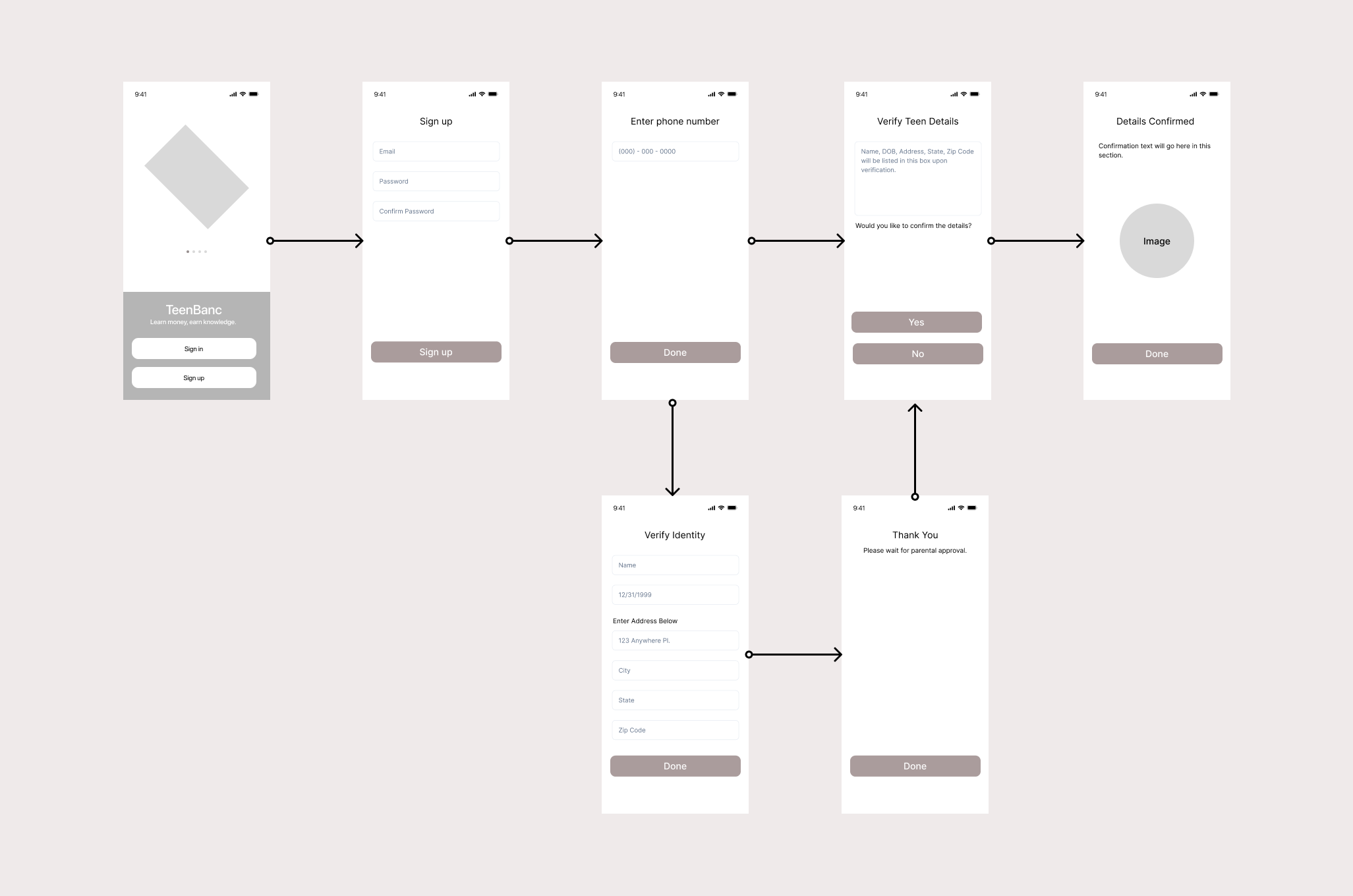

I categorized ideas for the app into 5 categories. After brainstorming, I narrowed the list down to the 4 features that would benefit teens the most. The final features help teens learn money skills by breaking down concepts clearly for the first time using quizzes and visual guides. Using wireframes and user journeys, I was able to think deeper into the security features (ex. onboarding), as well as app features that benefited teens.

Delivering the experience

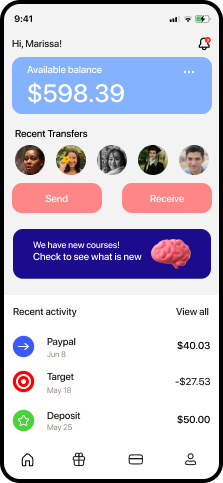

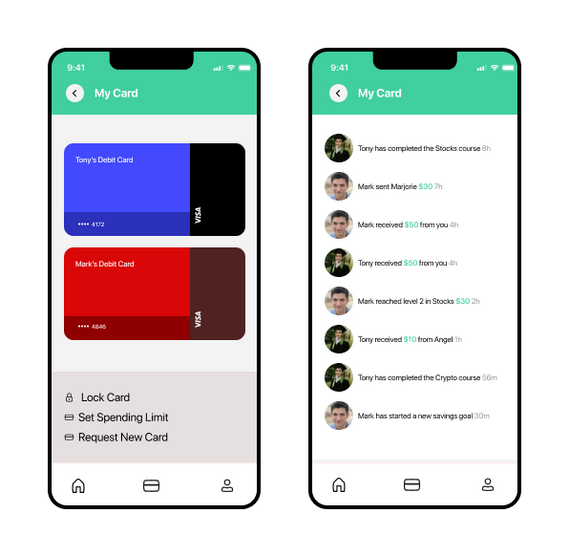

Everything, everywhere, all at once

Teens are welcomed by a user-friendly dashboard that makes financial features readily accessible. A clean, simple interface allows teens to quickly access balances, transactions, goals, and more right from the home screen.

Safe and secure

While teens have control of their accounts, one main concern is privacy and potentially oversharing account activity. To combat this, the following security measures have been taken:

- Spending trends without individual transactions

- General usage and financial literacy progress updates

- Parent notifications for concerning signals or milestones hit

- Fraud alert and protective admin measures (ex. card management)

This offers a system of trust that balances financial responsibility for teens, while giving parents peace of mind and preventing fraud.

Your goals, your way

Teens allocate funds to multiple goals, fostering good saving and money management skills.

A priceless learning experience

The app offers financial education tailored to teens, including courses on budgeting, saving, investing and more. Earning streaks helps keep teens engaged through recognition, motivating them to become better stewards of finance.

Learnings

Value the user's voice.

My goal to create an app that helped teens learn finance led to assumptions that were challenged. The feedback I received resulted in iterations to certain features that were more desirable. This allowed me to build an app for how teens actually want to learn, not just what I guessed.

Transferrable skills are beneficial.

Working at Betterment taught me that people need education and confidence-building around finances. I designed app features like animated explainers and interactive budgets for teens the same way we offered investment guidance to adults — with clarity, patience, and focus on building money skills over time.